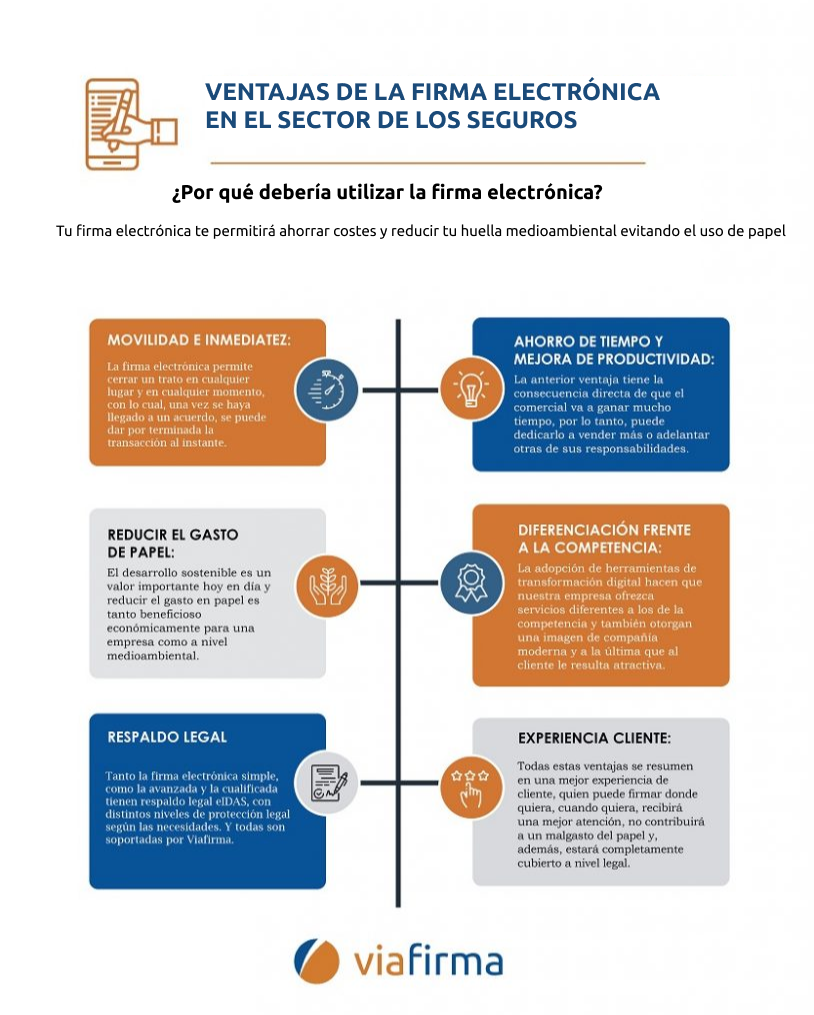

Viafirma’s signature for insurance companies helps them to be more efficient and competitive, allowing them to close policies on the same day without the need to go to an office and improving the user experience.

The boom of e-commerce and the coronavirus crisis has boosted the purchase and sale of products and services from home, making the electronic signature an indispensable ally to close any type of agreement securely and 100% online.

The insurance signature, an essential tool for your business

There are many reasons why documentation abounds in the insurance industry, both because of the number of clauses per contract and the strict rules related to policy documentation. That’s why insurance brokerages that want to simplify things for their clients are starting to implement electronic signatures in their processes. They understand that offering the opportunity to complete these formalities online will streamline their processes, avoiding scanning or faxing contracts and facilitating the closing of deals on the same day.

Companies are increasingly adopting digital tools to be able to conduct business remotely. Today’s technology has changed the way in which customers relate to companies of any kind. Even so, some have not been able to see what the market trends were and apply them, so they have been subordinated by other companies, especially by startups born in recent years in the digital era.

Does it comply with industry regulations?

Thanks to new technological advances, the consent that was previously expressed through a traditional handwritten signature can also be expressed with our electronic alternative wherever you are.

Within the territory of the European Union, Regulation (EU) No. 910/2014 of the European Parliament and of the Council (eIDAS) is the legislation that is responsible for regulating and defining 3 types of electronic signature within its member countries:

- Simple: This refers only to the electronic data used by the signatory to carry out the signature. Although it is perfectly legal and can be presented in court, it may require additional evidence because it is the least secure option possible.

- Advanced: Refers to a company that meets the conditions set forth in Article 26 of eIDAS, which are as follows:

- The heading must be uniquely linked to the signatory.

- It should allow identification.

- The user must have control over the data used for its creation.

- It must be possible to detect if there have been any subsequent modifications.

- Qualified: This is an advanced electronic signature that has been created by means of a qualified device and with a qualified certificate. Its legal value is exactly identical to that of the traditional handwritten signature.

All of them are perfectly legal. Thus, an insurance policy that will require consent between insurer and policyholder can be closed telematically using any of them.

Viafirma Documents: mobility and speed when signing insurance policies

As the number of digital insurance alternatives increases, digital transformation is essential to attract new users. Today, a client can sign and keep a copy of their policy without leaving their chair. No more waiting in line to pick up or return signed documents.

On the other hand, the easier the use of any tool is, the more likely it will be accepted by the final users. Viafirma Documents allows the signature for insurance from anywhere and with full legal guarantees.

Once they have read the contract and have given their consent to the policy clauses with our check boxes, your customers can finalize the process online, from home or anywhere, almost immediately, using a computer, tablet or cell phone and without a digital certificate.

This mentality of putting the client and his needs first brings direct benefits. The introduction of new simple and intuitive digital technologies such as Viaifirma’s will help differentiate your business from the competition, since most customers prioritize those companies capable of offering this type of procedures telematically.